By Jarrett Banks

Shapeways Inc. is disrupting manufacturing through 3-D printing. The digital manufacturing platform is going public through a merger with a SPAC called Galileo Acquisition Corp. (NYSE: GLEO).

IPO Edge sat down with CEO Greg Kress to find out more about going public and future M&A.

IPO Edge: We’ve seen a number of 3D printing companies enter public markets in recent months? How are you different from others in 3D Printing and Digital Manufacturing?

At our core, Shapeways helps companies turn digital designs into physical products. The reality is that the manufacturing market is slow, manual, and rigid – largely due to the fact it has been traditionally focused on mass production. While this setup has some benefits at scale, the current market environment has exposed many inefficiencies in meeting modern demands. This older ecosystem is simply unable to meet today’s rapidly changing customer needs, offering the required agility to quickly adjust to various market shifts. The pandemic, especially, shined a bright light on this inadequacy – a challenge that is commonly encountered across the manufacturing sector-at-large.

Meanwhile, digitizing the manufacturing process from end-to-end generates increased speed, lower costs, and higher flexibility. This is the promise and tangible benefit of Digital Manufacturing, and why the global market is expecting to build on this rapid expansion, standing at $39B in 2020 and growing to upwards of $120B by 2030, based on industry forecasts, based on Wohlers Report 2020.

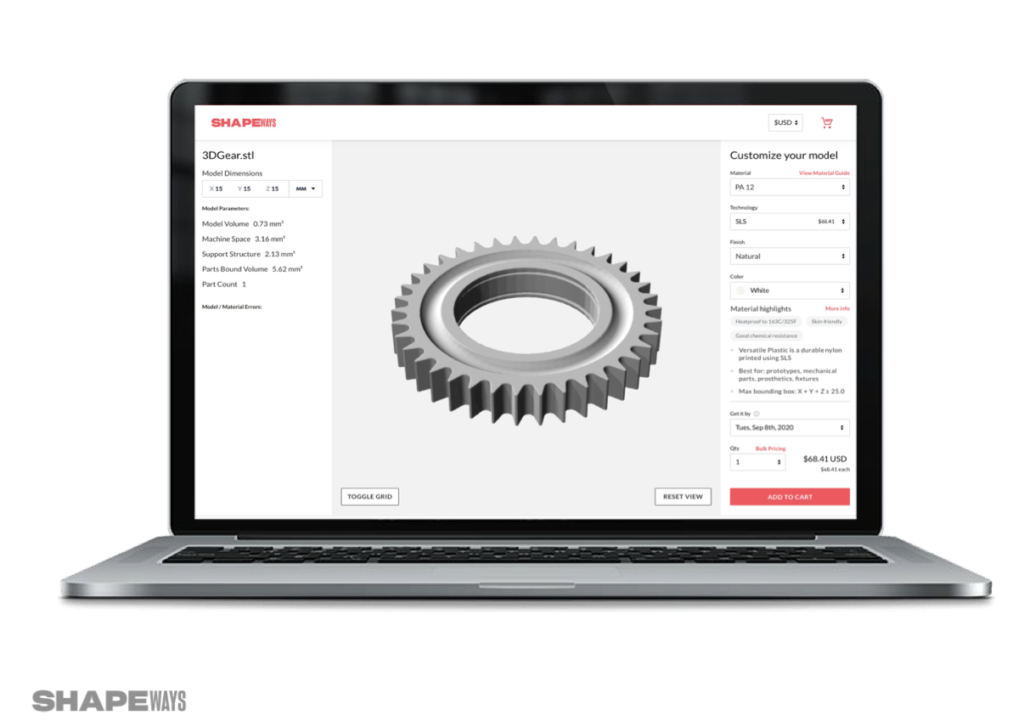

Shapeways is a leader in the digital manufacturing space, having delivered over 21 million parts to more than 1 million customers across 160 countries, to date. We accomplish this with a business model that incorporates a mix of internal and external supply chain partner production. What further distinguishes Shapeways is our purpose-built, proprietary software platform that makes on-demand manufacturing a reality. Essentially acting a “Digital Manufacturing Operating System,” this platform incorporates over ten years of industry knowledge and leverages our agnostic approach to both materials and hardware – offering a level of versatility and optionality that is rarely found in traditional manufacturing.

The result is a faster, higher quality end-product manufactured with a process that is both efficient and profitable. And this is the essence of Shapeways.

IPO Edge: Why are you going public now, and how will it benefit the business?

We spent the past few years heavily investing in Shapeways’ technology, reshaping our business to be more efficient and achieve higher levels of sustained, organic growth. This has put the company on an entirely new trajectory, compared to the TAM and business model it was founded upon a decade ago. Going public now through our SPAC merger with Galileo Acquisition Corp. sets Shapeways up for accelerated growth. And while our financial projections are currently based on organic growth, the public market currency generated from entering the capital markets could support some compelling M&A activity that can add a new dimension to our growth plan and TAM.

As a testament to all of this, [nearly all of] our stellar roster of private investors have invested further in our PIPE, underscoring a belief in our vision of becoming a world leader in digital manufacturing.

Collectively with our investors, we believe that we can steadily drive equity value creation. From a company perspective, we are anticipating 66{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} in revenue CAGR from 2022 through 2025 through organic growth, with an additional $150 million in near-term revenue opportunities identified via acquisition targets. We’ll also be growing beyond additive manufacturing as well as adding revenue streams as our manufacturing and software capabilities show growth, paving a clear path to twelve-times revenue. We believe the opportunity exists to continue to build margin through continued improvements in our comprehensive manufacturing offerings and a focus on high-value added service along with a continued drive toward profitable asset-utilization.

From a market perspective, we plan to leverage our market leader positioning, unlock new industries, and enter new geographies – all propelled in part by favorable market tailwinds.

IPO Edge: Shapeways recently announced Q1 2021 business results, which showed continued growth in both revenue and gross profit. Can you give us insight into these results and the business drivers for them?

Yes, the financial results from Q1 match our overall growth plan for the year. Our 2021 first quarter revenue increased by 11{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} to $8.8 million compared to $7.9 million in the first quarter of 2020. Meanwhile, our gross profit grew 30{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} year-over-year to $4.1 million in the first quarter of 2021, as gross margins improved to 47{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} in the same period due to high value product focus, continued operational improvements, and further software development.

This growth can be attributed to our sustained focus to scale across markets and expand our customer engagements across the industrial, medical, automotive and aerospace segments. Further, we plan to continue to extend strategic partnerships with innovative additive companies to broaden our offerings. This enables us to better serve our customers’ current and future manufacturing needs, including full color 3D printing, in both domestic and worldwide markets.

IPO Edge: In the Shapeways investor deck, you outline some key API-based integrations with big names like Shopify, Amazon, and Etsy. How does this factor into your service capabilities and revenue stream?

Yes, we have built our software with integrations in mind, and have activated some big name brands and their respective stakeholders into our ecosystem — from pure play eCommerce platforms to those who offer both their own products along with merchant stores. Not only do we help them solve very specific needs with digital manufacturing, they’re finding ways to extend their own capabilities to open up new revenue streams for their merchants as much as themselves.

At the core, our API enables anyone with Shopify or Etsy shop to connect to our platform for real-time digital manufacturing. Ultimately, this integration helps them to reduce the need of inventory, preserving cash and working capital for merchants while immediately expanding their product inventories and revenue potential.

IPO Edge: Based on your experience nearing the halfway point of 2021, where do you feel are the best opportunities to expand your business throughout the rest of this year, and into 2022? And where will you focus your CAPEX?

We feel there are opportunities for Shapeways to further support our current client roster, while growing our list of new client logos at the same time. Traditionally we have benefited from high rates of repeat revenue – making up 88{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} of revenue in 2020.

The expansion of our materials mix – including a bevy of coatings and finishes for them – as well as collaborations with 3D printing technology vendors are key. Today, we offer 90 materials and finishes, which we expect to grow to 250 over the next five years. In addition, we plan to expand our CNC, injection molding, and sheet metal offerings from where they are today. Our evolving collaborations with Desktop Metal, DSM, BASF and other leaders in the manufacturing industry, are examples of how we can seamlessly add to our suite of offerings. And we see more great opportunities on the horizon to capitalize on similar synergies with other vendors as technology innovation continues to shape our industry — increasing potential for net expansion along the way.

In expanding our materials and technology offerings, we can also expand our parts envelope – which will ultimately equip us to grow our revenue possibilities within these existing industry sectors, as well as adding to them. New verticals we will likely target include robotics, gaming, consumer products, transportation, and more.

Additionally, we will continue to look at geographical expansion opportunities. For instance, the APAC region sees about $3 trillion in annual manufacturing output. So even early, relatively small wins in penetrating this largely untapped market with a strong digital manufacturing offering can be meaningful for our growth plan.

Ultimately, we will continue to invest in the business, and while we can’t fully dictate the timing, we believe the return on the investments should continue to result in growth of revenue and margins, alike.

IPO Edge: How will M&A play into your growth plans?

Our current projections reflect organic growth alone, but we believe that there will be opportunities for inorganic growth through strategic acquisitions and tuck-ins as well. We believe our scalable financial and operating model will enable us to consolidate what has become a rather fragmented market in digital manufacturing, creating the potential for significant shareholder value as a result.

Because our software platform is both material and hardware agnostic, we have the versatility to add new acquisitions into the flow of our digital manufacturing offering — allowing Shapeways to reap the benefits of economies of scale. New business added from or attracted by any new acquisitions also gain access to our supply chain network of over 50 high quality strategic manufacturing partners to support long-tail product demands, helping to grow net retention percentages driven by the reach of the Shapeways platform. Additionally, we anticipate that our optimization of pre-production materials trays will enable us to gain on margins as well.

We are always on the lookout for other disruptors that could complement our business and serve to accelerate our growth – by either strengthening existing offerings, or adding new offerings or geographies to the mix.

IPO Edge Contact:

Jarrett Banks, Editor-at-Large

Twitter: @IPOEdge

Instagram: @IPOEdge