- Avalon Acquisition Inc. (Nasdaq: AVAC) merging with The Beneficient Company Group “Ben”

- Ben’s tech-enabled platform provides liquidity to holders of private equity and alternatives

- Ben helps medium-to-high net worth individuals get cash from illiquid long-term vehicles

- Ben’s technology lets clients get liquidity much faster than other services

- Public listing clears the way for explosive growth as Ben uses shares as currency to expand

- Major advantage as industry’s only trust company acting as principal and fiduciary

- Directors include former Federal Reserve Presidents Richard Fisher, Dennis Lockhart

- Reasonable valuation at $3.5 billion based on IPO Edge revenue and profit estimates

- Already closed private raise of $383 million before AVAC merger announced

- Led by Founder and CEO Brad Heppner, alternative asset industry veteran

Private equity and other alternative assets aren’t just for big institutions or the ultra-wealthy anymore. Even “regular” rich people can invest in funds from the likes of KKR & Co. Inc. and Blackstone Inc. But what if they need to cash out early?

Meet The Beneficient Company Group “Ben” which is going public through a merger with Avalon Acquisition Inc. (Nasdaq: AVAC). Ben is a technology-based platform designed to help medium-to-high net worth individuals and smaller institutions exit illiquid positions in alternative assets like private equity, which typically lock up investor money for a decade or so.

Why is such a service needed? In recent years, many so-called secondary funds have emerged that snap up investor interests in funds. But the process is time consuming and generally designed to deal with positions of several million dollars or more.

Ben, however, has streamlined the process so investors can apply for a quote entirely online – much like a car insurance quote on a standardized form. The tech allows Ben to offer liquidity in transactions as small as $100,000 – far below typical transactions that occur now.

Ben is also fast. The company offers liquidity quotes in 30 days or less. That compares with traditional secondary processes that can take a year or more and provide less price discovery.

What’s more, Ben has secured a legal charter to operate as a technology-enabled fiduciary financial institution. That gives Ben a unique ability to offer, at scale, liquidity along with custodial and administrative trust services – something a so-called secondary fund buying up alternative assets can’t do.

Ben has another big advantage: access to balance sheet. Since it uses loans for financing, Ben’s cost of capital can be a fraction of a secondary fund’s. Already, Ben has financed transactions to delivery liquidity on over $1 billion in assets since 2017.

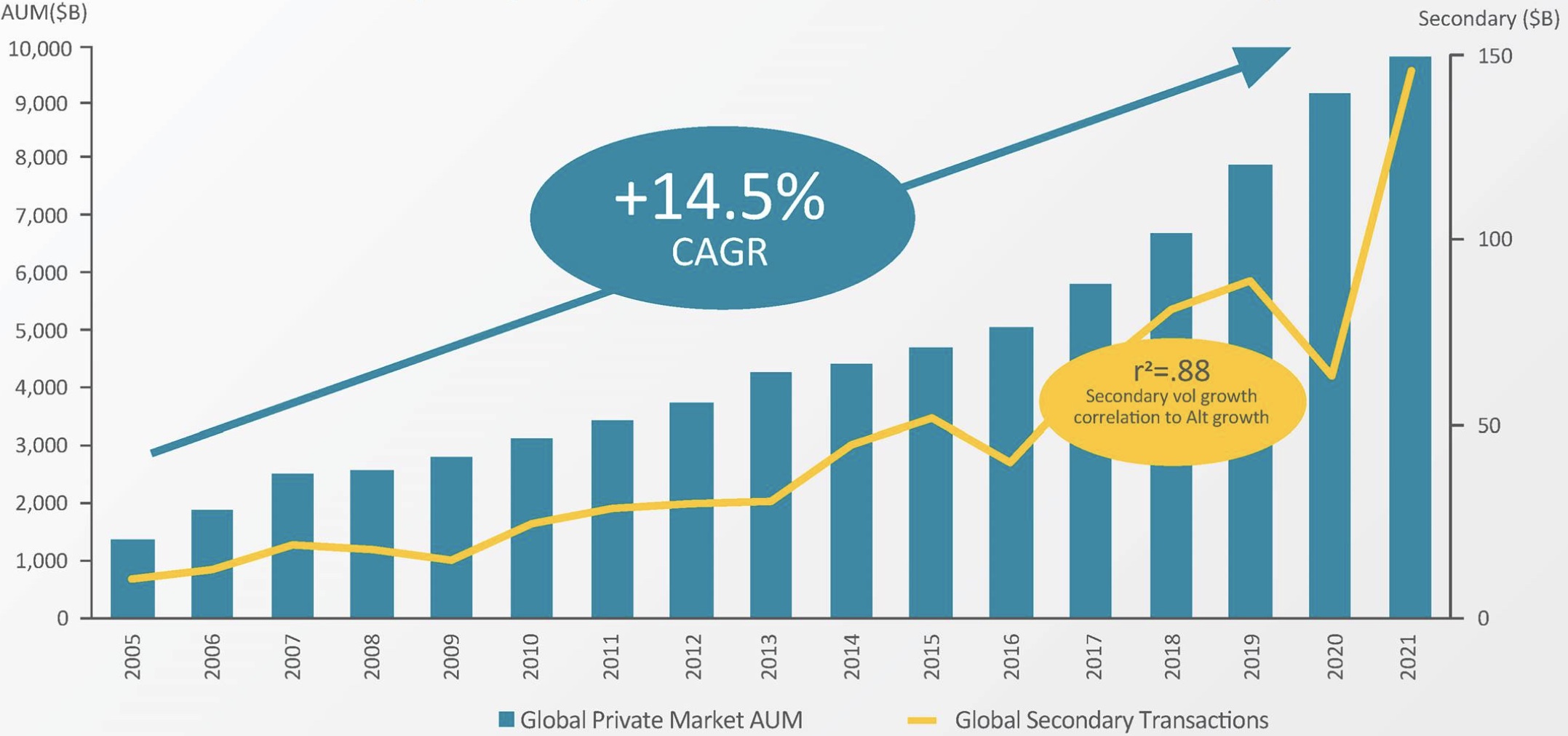

The industry has serious tailwinds thanks to the proliferation of alternatives sold via private wealth managers, multifamily offices and various other mechanisms that “democratized” the asset class. As the chart below shows, the demand for secondary sales is extremely correlated with growth in assets, indicating a bright future for Ben as the industry proliferates.

(Source: Beneficient)

What’s the financial opportunity for Ben? There is about $51 billion in annual demand for liquidity among Ben’s target investor groups, according to Preqin, a third-party provider of data on alternative assets. Conservatively assuming Ben can obtain 10% market share in the near term, it would provide about $5 billion of liquidity annually.

IPO Edge estimates point to significant revenue – and operating profit. Based on last year’s financials, Ben generates revenue equivalent to about 8% of liquidity provided. Assuming the same percentage, Ben should generate over $400 million of revenue once it reaches 10% market share – something that’s feasible in a year or two.

At $10 a share (implying an enterprise valuation of $3.5 billion) Ben is available to buy now via shares in AVAC at roughly 8 times sales. That’s reasonable for a fintech company a proven track record. Indeed, both of Ben’s key business units, liquidity and custody services, generated positive operating income in 2021.

Ben is well on its way to delivering impressive numbers. Already, the company reached a run rate of about $100 million of revenue in the March quarter, but the going-public transaction stands to accelerate growth for multiple reasons. One, Ben should have a healthy pile of cash on its books once the merger closes. Equally important, Ben can use its public shares as currency as it provides liquidity to alternative asset holders.

Indeed, Ben conducted a survey of 600 asset managers and found that just 10% sought all-cash liquidity options. Some 68% would choose a combination of common equity, preferred equity and incoming producing bonds, according to the survey.

Looking further ahead, Ben should benefit from the growing role of alternatives among affluent individuals and small institutions. It also could gain much more than 10% market share given its unique offering and relatively low cost of capital. It can expand further into other areas such as illiquid assets held in 401k retirement plans – a massive opportunity.

Of course, complex financial companies like Ben will need to comply with significant regulatory procedures. Thankfully, it has not one but two former Federal Reserve Presidents on its board: Richard Fisher of Dallas and Dennis Lockhart of Atlanta. Their expertise should help ensure Ben stays in compliance abreast of evolving rules.

An equally impressive director onboard is Tom Hicks, a private-equity industry legend who is Chairman of Hicks Holdings LLC. On the Avalon Acquisition team is CEO Craig Cognetti, who has over 20 years of experience in financial services.

Last but not least, Ben is already flush with cash, meaning the merger with Avalon should be viewed as a means to a public listing and not a critical source of capital. Ben recently completed a private placement of $383 million separate from the merger with Avalon – plenty to fund expansion.

Ben is no ordinary deal. With unique advantages against rivals, explosive growth, along with a rock star management team and board, investors would be wise to tuck away some shares for the long haul.

Contact:

IPO-Edge.com

Editor@IPO-Edge.com

Instagram: @ipoedge

Twitter: @ipoedge