- Portillo’s Inc. restaurant chain begins trading Thursday on Nasdaq (ticker: PTLO)

- Portillo’s is a Chicago institution known for hot dogs, Italian beef sandwiches and more

- Generates staggering avg. store volume of $8.7 million, easily topping Chipotle, Shake Shack

- Plans to expand to at least 600 stores from current count of 67 at 10% annual rate

- All locations are profitable and Portillo’s has never had to close a restaurant

- Demonstrated Ebitda growth in 2020 in the depths of Covid thanks to drive thru, delivery

- Expects long-term Ebitda growth in low teen % points on new stores, comp sales growth

- Priced at $20 a share, top of range, or 19 times 2022 Ebitda, well below fast casual leaders

- Gleans key geographic data about where to add stores from nationwide delivery business

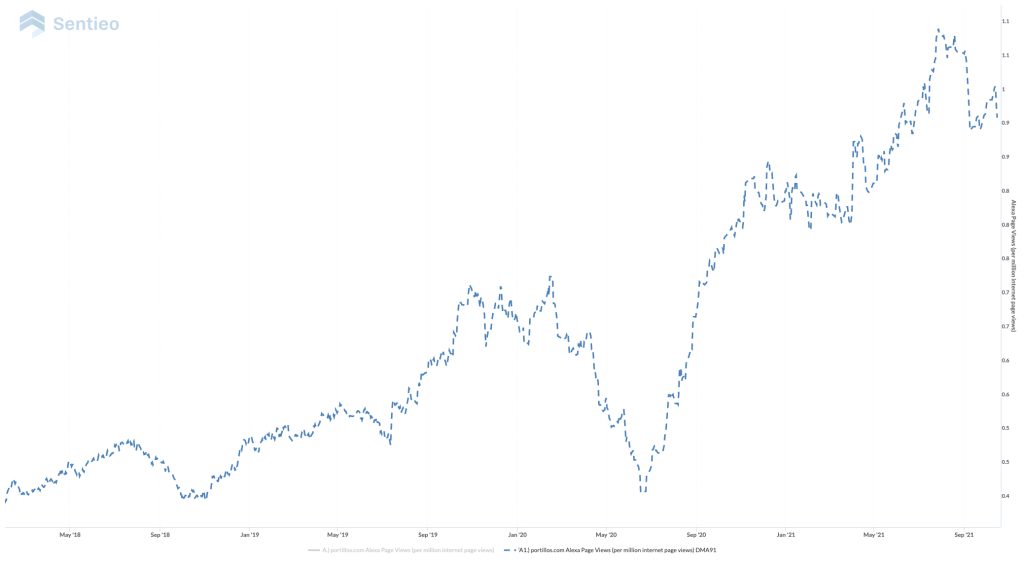

- Third-party data from Sentieo show strong momentum in Portillo’s internet search volume

- Avid fan base creates free marketing via social media, word of mouth that cannot be bought

Every so often, there comes a juggernaut like Chipotle, Shake Shack or even McDonald’s that sets a new benchmark in the restaurant industry. Chicago-based Portillo’s Inc. has all the right ingredients to become such a treat for investors.

The company, whose roots go back to a single take-out trailer called The Dog House in 1963, priced its IPO Wednesday night at $20 a share and beings trading Thursday on Nasdaq under the ticker “PTLO”. The deal comes at an unusual time because many restaurants suffered dearly during Covid-related shutdowns but Portillo’s is an example of a chain that powered through 2020 – even boasting a remarkable 10% rise in adjusted Ebitda last year when others saw catastrophic drops.

For those who haven’t had a chance to visit, Portillo’s Chicago-style hotdogs and Italian beef sandwiches have become as synonymous with the Illinois city as deep-dish pizza—the kind of delights Bill Swerski’s Superfans in Saturday Night Live might stack up before a Bears game. But the unique made-to-order menu that also features salads and chicken sandwiches along with a fun-filled ambience (each location is different with various Americana motifs from the 20th century) combine to attract loyal customers of all ages, all walks of life, and increasingly from across the county.

A look at the numbers backs up the impressive story. Take 2019, before Covid distortions impacted the industry. Portillo’s generated $8.7 million in average unit volume that year, with the best figures in the Chicago area but very high across the map.

That dwarfs virtually any restaurant in the quick serve or fast casual segment. Chick-Fil-A posted $4.7 million in average unit volume, Shake Shack $4.1 million and Chipotle $2.2 million.

Part of the Portillo’s magic is a highly-efficient drive-through strategy, which usually includes two lanes. That translated to twice as much average drive through traffic in 2019 as McDonalds – itself of course known for highly efficient service. Portillo’s even tops McDonald’s in overall traffic, with 2,563 average guests per day per restaurant versus 1,608. Shake Shack and Chipotle posted much lower numbers.

The company also adapted to Covid by taking decisive action to serve food by any means necessary – such as developing a robust delivery platform. Delivery volume is up 90% from 2019 and now accounts for 11% of sales. That channel will likely remain critical as many consumers grew fond of the convenience during the pandemic and will want it for years to come.

Portillo’s also embraced and supported its employees during the worst days of Covid. The company continued its streak of never closing a restaurant in 58 years, never furloughed or laid off any employees, and even launched an employee assistance fund, The Heart of Portillo’s Fund, to support team members facing hardships. Portillo’s continues provide 100% meal discounts to workers to ensure none go hungry.

Such thoughtful treatment of employees likely contributed to increased staff dedication and productivity. Average items per labor hour rose to 20.9 in 2020 from 18.7 in 2019 and continue to rise this year.

The company plans to average low single digit same-store sales across locations in years to come. To achieve that goal, it has several levers to pull, such as introducing new items like the successful spicy chicken sandwich while taking advantage of organic marketing by word of mouth and social media (see Dwayne Wade cheering for Portillo’s on Twitter).

Then there is tremendous potential to expand across the county. Portillo’s plans to grow its footprint at 10% a year, reaching over 600 stores in the long term – nearly 10 times its current number.

Of course, skeptics may argue that consumers in parts of the country may not embrace Portillo’s and it could stumble. But there are several arguments that indicate otherwise.

First, Portillo’s isn’t simply going to open restaurants haphazardly across the map. Instead, the company plans to execute in eight states over the next decade, adding 120 to 150 new restaurants, some of which are in the Midwest where its brand recognition is strongest.

The newer states, such as Florida (where it has three locations), Texas and Arizona, weren’t chosen at random and restaurants there have performed well. Another secret weapon: The company has a significant delivery business across the country, sending meals to make at home, and that operation gives it precise intelligence about where demand already exists.

What’s more, objective data show a sharp uptick in awareness. Alexa search results, as tracked by Sentieo, an an AI-enabled research platform, show traffic rising consistently over the last few years. (See the chart below as an illustration).

Portillo’s shares also look cheaper than the best comparable companies despite its superior fundamental metrics. At $20 a share, the company has an enterprise value, adjusted for net debt, of about $1.8 billion. That implies a multiple of 19 times 2022 Ebitda, conservatively assuming the company matches its 2019 performance next year. Chipotle trades at 33 times, Shake Shack at 28 times and Dutch Bros., another hot IPO, at 98 times, according to Sentieo.

Portillo’s has come a long way from its humble Chicago beginnings. But with the current strategy in place and an unrivaled track record in the toughest conditions, investors should not be surprised to see the stock follow suit and outperform the pack.

Contact:

John Jannarone, Editor-in-Chief

editor@IPO-Edge.com

Twitter: @IPOEdg