Reg A+ IPOs are best suited for companies that investors can understand in half a minute or less, meaning the path works for those with pithy, uncomplicated stories to tell. That’s according to Mark Elenowitz, CEO of investment bank TriPoint Global Equities, which has underwritten several Reg A+ IPOs since they kicked off last year, including FAT Brands (ticker: FAT), Myomo (MYO), Level Brands (LEVB), along with offerings from Muscle Maker and iPic expected in 2018. In a wide-ranging interview with RegAResearch, Mr. Elenowitz gives his take on what works best in a Reg A+ IPO, what’s behind the recent poor stock performance of new issues, and his expectations for 2018.

RegAResearch: For private companies seeking to go public, what are the most important reasons to pursue a Reg A+ IPO?

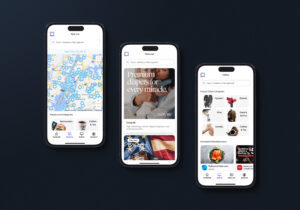

Mr. Elenowitz: I firmly believe the Reg A+ is going to bring back small-cap IPOs. It’s an innovative way to market an opportunity to non-accredited investors, across all 50 states, using general solicitation, including the internet and social media. Reg A+ allows issuers to market directly to their customer base, followers, and affinity groups, with all them to become shareholders. The very people that love the product can own the company. What is key is that the Company can market their offering in a modern world utilizing social media, digital marketing and real-time communication.

RegAReseach: Are there instances when both a traditional IPO and a Reg A+ IPO are possible, and should some companies choose one over the other?

Mr. Elenowitz: Reg A+ is designed for companies that have are consumer focused and easy to understand. Investors have 30 seconds to understand the Company. Life Science companies, including biotechs, have complex science and technology behind their innovations. This data and information requires a more informative explanation and education for investors to understand the merits of the opportunity. When marketing a Reg A+ opportunity, the story needs to be short, direct and easy to understand. Reg A+ investors will typically spend on a few minutes at most determining if the investment is of interest. Explaining a biotech takes time and needs to have further detail beyond the short presentation. While ultimately the biotech opportunity may be a great investment opportunity, the investor will move on in their search before the story is properly explained. Those types of issuers are best suited for an S-1 with a broker-dealer explaining the story. For a Reg A+ candidate, the offering allows the following:

-

- Provides small-cap issuers ability to raise up to $50 million in a 12-month period

- Raise capital faster than traditional methods

- Both accredited and non-accredited investors can participate side-by-side

- National Blue Sky exemption (can market to all 50 states)

- Allows “test the waters” (TTW) period to determine investor appetite

- Enables use of public channels such as email or social media to market an offering

- Reduced filing and compliance requirements for issuer

- Elimination of quiet period

- Can continue to raise capital during filing process

-

- Leveling playing field for individual investors to participate on same field as Wall Street

- Transparency of information

- Settles through DTC

- Supports digital communication in modern world, capitalizing on social media (e.g. Facebook, email marketing, Twitter, Instagram, etc.)

RegAResearch: Every Reg A+ IPO stock has declined since listing in 2017 while the broad market has risen. What are the reasons for the poor performance?

Mr. Elenowitz: This has been a huge issue and is not a Reg A+ issue, but rather a company-specific issue. Many of the recent offerings were done at huge valuations and in reality should not even be a public company. Reg A+ is not broken. Some of these companies have no revenue or earnings, no funds in the bank or paid-in capital but believe they are worth $300 million-plus. These issuers need significant money beyond the IPO to develop their product and need to raise more capital to keep their lights on.

There are many service providers that are not licensed and receive a fee regardless of whether the transaction is completed or not. These service providers are playing into the issuers dreams of raising huge amounts of money at huge valuations. This is not realistic. In addition, the broker dealers are looking the other way when it comes to pricing and valuations, hoping the crowd will ignore the poor fundamentals. The Crowd is not uneducated. They may have an affinity towards the product, but they also need to understand the risk. Transactions should be structured based upon defensible projections, assumptions and peer’s valuations. Those CEOs who recognize this will have successful offerings.

RegAResearch: What is necessary for Reg A+ stocks to perform better?

Mr. Elenowitz: I believe the single biggest issue is education. There is a disconnect amongst service providers in truly understanding the benefits of Reg A+. Reg A+ is not bad; mis-pricing of companies that are not ready for public markets is bad. We need to see continued education to issuers, service providers and the Wall Street community.

In addition we need:

- Increase valuation and pricing scrutiny

- Better disclosure of risk to execute business plans beyond initial capital raise

- Wider institutional adoption needed

- Research analyst education

- Education of compliance officers of mid-tier broker-dealers

- Require all platforms / portals to be registered with SEC and FINRA in similar manner to Reg CF

- Enforce short selling rules and Reg T compliance on IPO

RegAResearch: Some critics argue that the poor performance is a manifestation of adverse selection, meaning the worst companies have nowhere else to go for capital. Is this fair?

The small-cap market and capital formation has been limited for small issuers of the past several years. It is very difficult for companies to conduct public offerings. Most capital raises were done as PIPEs (private investment in public equity) which is limited to accredited investors. We have seen the number of IPOS trail off but Reg A+ is an opportunity to bring back the small-cap IPO. In the past the only way for issuers to conduct an IPO was to use an investment bank. The number of banks that participate in these small underwritings is very few. The larger investment banks are still conducting offerings for larger companies and raises, but there was a void for the smaller issuer. The traditional IPO has a significant amount of regulation that limits what information can be communicated to potential investors and when.

The TriPoint methodology is to work with iconic companies with large followings, strong customer bases and high visibility. These are companies doing $20 to $200 million in revenue. These are absolutely not the worst companies. These are companies that want to reward their customers and allow them to finally have a seat at the table with institutions. With our methodology there is no reason to do a traditional IPO. Our Reg A+ IPO’s look, act, feel and most importantly settle like a traditional IPO. Reg A+ allows the use of Test the Waters, which allows communication about the offering before filing, during the filing process and after qualification. This is a huge change that allows issuers to gauge interest not only from the Wall Street community, but also from the crowd. Issuers can now spend time developing investor interest and more importantly can do so using the internet and general solicitation across all 50 states to non-accredited investors. We now can have a convergence of traditional underwriting with electronic offerings. This hybrid approach is what we are doing for our clients. It is made up of three parts: crowd, institutions and Wall Street syndicate. This allows institutions to follow the crowd sometimes confirming or validating the prospects of the product or service, and the crowd to follow pricing and structure that professionals demand.

What predictions do you have for Reg A+ IPOs in 2018?

Reg A+ is the return of the small cap IPO. The market is still in its infancy but it is developing daily. As more issuers and investors continue to adopt Reg A+, the market will mature. I believe that in the future, there will be no need for S-1s for small cap issuers and mid-tier banks will embrace Reg A+ as a means to complement institutional placement with retail distribution.

Currently only a small portion of offerings are driven by the crowd and we believe that over time the crowd will become a large piece of the shareholder distribution in the offering. We will see a move away from issuers in consumer and retail industries to others. In addition, larger issuers will utilize Reg A+ to expand product awareness and connect with customers. I also hope to see more non-sponsored research will be initiated on issuers and I believe Main Street will become more educated and aware of opportunities in Reg A+.