- Horizon Acquisition Corporation (ticker: HZAC) merging with Vivid Seats in SPAC deal

- Ticker will automatically flip from HZAC to SEAT and trade on Nasdaq after deal closes later in October

- Vivid Seats offers secondary market for ticket buyers and sellers, taking a fee from each sale

- Company swung back to profits earlier in 2021 as fans returned to live events in droves

- Vivid Seats will pick up $750 million in cash from transaction regardless of any redemptions

- Cash will leave Vivid Seats with a clean balance sheet for marketing or potential M&A

- CEO Stan Chia brings serious experience from Amazon and COO role at GrubHub

- Clear plan to boost brand awareness, including partnerships with Disney’s ESPN, DraftKings

- Rewards program has proven effective, driving massive shift from web to app customers

- Rival StubHub has been held back by antitrust issues in Viagogo merger, likely very indebted

- Vivid Seats trades at 14x 2022 Ebitda, well beneath comps Live Nation, Etsy, DoorDash

- Vivid Seats’ projections appear too low, given 2Q beat and upward revisions at peers

Demand for live events is back with a vengeance. To capitalize on the trend, investors should consider a rising star that’s poised to please the crowd while knocking out the competition.

Meet Vivid Seats, a highly profitable secondary ticketing marketplace that offers seats to everything from Hamilton to the Super Bowl. Vivid Seats is going public through a merger with Horizon Acquisition Corporation (ticker: HZAC) and will begin trading under “SEAT” on Nasdaq shortly after the deal is formally approved at a shareholders meeting on October 14.

To understand the Vivid Seats opportunity, it’s important to understand the history of secondary ticket sales. Ticket scalping was once an unsavory business that took place in shady streets and dark alleyways. Not only was it legally questionable for the sellers but put fans and show-goers at risk of fraud. That meant many people were forced to make commitments through formal channels or even buy dozens of games they might not attend in season ticket packages.

Now, thanks to technology, it’s possible to make live-event choices at the very last minute and be assured great seats – often at incredible prices. There are a number of operators in the industry, but none are positioned as well as Vivid Seats to ride the trend and take share from rivals as it boosts its brand presence.

Investors should first note the financial transformation that will come with the SPAC deal. Even if there are some redemptions, the company has a commitment from one of its PIPE investors to replace them with share purchases at $10 each. That means the company can expect to have no net debt upon close.

Such financial firepower is very timely. First, it could allow the company to scoop up rivals – ideally taking out cost synergies and boosting profits while adding scale.

More imminently, the company can use its clean balance sheet to build brand awareness and attract both ticket buyers and sellers. Vivid Seats is already well on its way with great partners: It has inked deals with Disney’s ESPN, Rolling Stone and DraftKings Inc., all ideal partners to help get in front of customers.

CEO Stan Chia has also overseen other smart moves during his tenure. The company was an innovator with a rewards program – the only one among its major rivals – that offers customers rewards on every ticket they purchase.

Shrewdly, Vivid Seats makes customers redeem those rewards on its mobile app, which is preferred because it lives on their phones and the company can send “push” notifications. In the last few years, sales on the app have risen from the single digits to over 40% of total volume.

The company, which was already very profitable before the pandemic, has come back swinging. In the second quarter, Vivid Seats posted better-than-expected volume and sales, contributing to a healthy Ebitda of $36.2 million.

Indeed, the company’s projections (which were established earlier this year and cannot be modified until the deal closes) are for revenue in 2022 to fall slightly short of 2019 levels. If the company were free to alter its forecasts, it looks extremely likely it would have already done so.

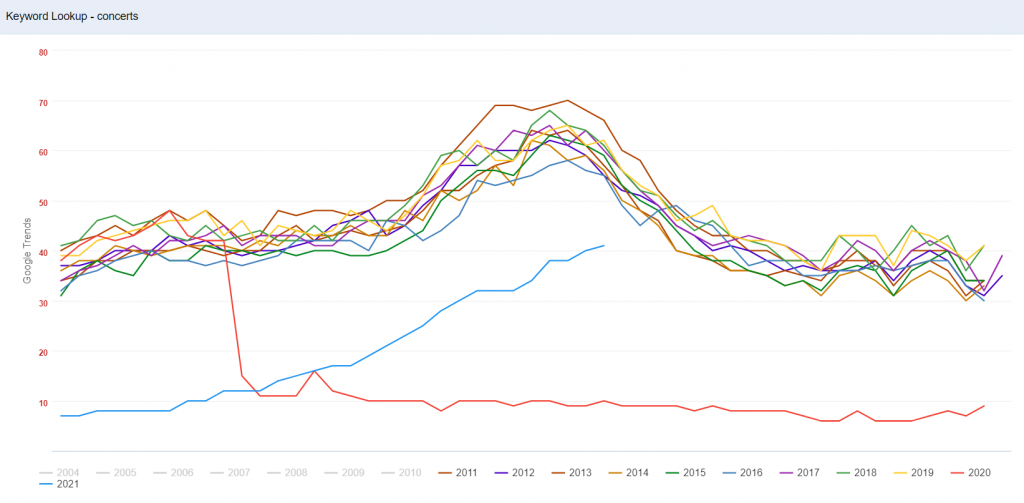

There is more evidence to make that case by looking at third-party data and projections for other companies in the industry. Consider the charts below from Sentieo, an AI-enabled research platform. The first shows annual stacks of Google searches for concerts, which typically rise during the summer and pull back in the autumn. Not surprisingly, they dropped steadily in 2020. But this year, they have marched higher even into September and October, reflecting immense pent-up demand.

The second chart shows revenue estimates for Live Nation Entertainment, Inc. which of course reflects sales of the same kinds of tickets that fuel volume at Vivid Seats. While the top two forecasts (for 2022 and 2023) dropped sharply in the pandemic, they have steadily inched higher in the last several months.

Source: Sentieo

It’s also important to remember that Vivid Seats may face weaker competition than normal in the current climate. StubHub recently entered a multibillion-dollar merger with Switzerland-based Viagogo. That deal has been hotly contested by antitrust authorities and though it appears set to go through, it could leave the company saddled with debt and unable to market itself as effectively as Vivid Seats.

Vivid Seats is also priced right. At about $10 share it has an implied enterprise value of 14 times 2023 Ebitda. Live Nation Entertainment, Inc. trades at 18 times, according to Sentieo. But the better comps with similar marketplace characteristics trade far higher: Etsy commands a multiple of 27 times and DoorDash at 66 times.

There is also strong leadership – and confidence – at the top. Mr. Chia spent years at Amazon and most recently was Chief Operating Officer of GrubHub, which gives him keen insight into the business model. The existing shareholders are rolling 100% of their equity into the newly-formed business rather than taking a single dollar off the table. The SPAC itself is led by Todd L. Boehly, former President of Guggenheim Partners which has one of the best track records in the media and entertainment industry on Wall Street.

Savvy investors are taking notice of the opportunity. Vivid Seats warrants, which trade separately (now as HZAC-WT and will convert automatically to SEAT-WT) have marched higher in recent weeks from about $1.40 to $1.83 at Thursday’s close. Whether it’s warrants or common shares, investors should grab these tickets before more of the world takes notice.

Contact:

John Jannarone, Editor-in-Chief

editor@IPO-Edge.com

Twitter: @IPOEdge