- Blackstone Products is merging with Ackrell SPAC Partners I Co. (Nasdaq: ACKIT, ACKIU, ACKIW), with pro forma enterprise value of $900 million

- Known for outdoor griddles popular on social-media platforms TikTok, Instagram

- More consumers preparing food at home during pandemic, continuing beyond

- $5.7 billion global TAM; expanding into markets across Europe, Asia, Latin America

- Long-term relationships with key retailers Walmart, Lowe’s and Amazon, plus direct-to-consumer sales

- Expects over $600 million of revenue in 2022

- 11.1x 2022E adjusted EBITDA of $81 million implies discount to Weber Inc., Traeger, Inc.

A TikTok user named Carvell Kane made a video of himself cooking cheeseburgers for his family in his backyard that has been viewed 4.7 million times. The secret sauce? Blackstone Products’ griddles.

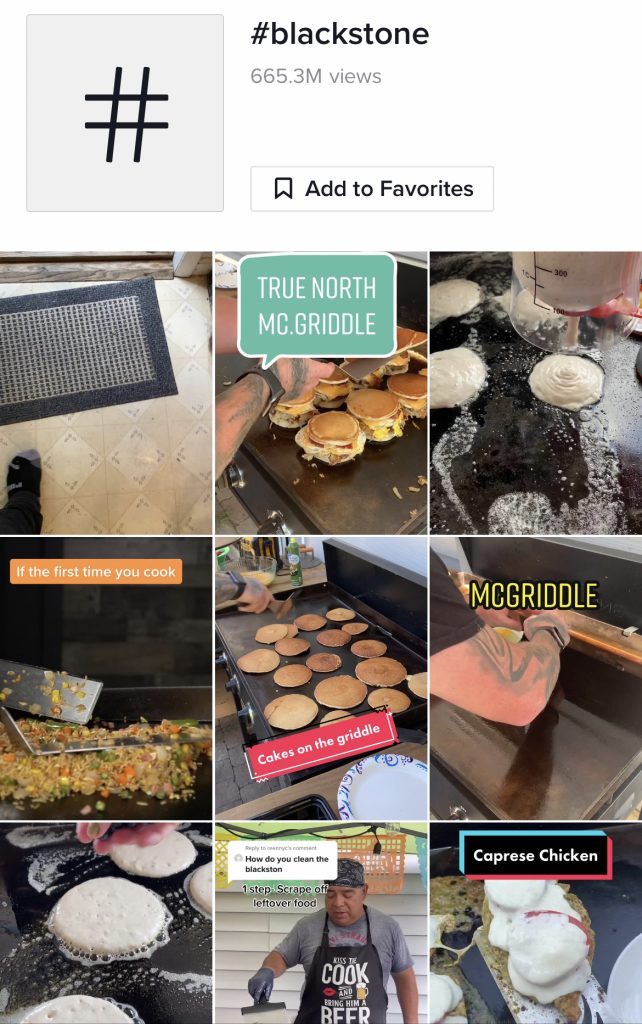

Mr. Kane is part of a trend of outdoor cooking during the pandemic that continues even as people resume some normal work habits. And using a griddle, which has a smooth, flat surface and can be used to cook many different meals from morning to night—similar to something you might see at Benihana—just happens to be more visually appealing than smoking meat for eight hours. So much so, that the hashtag #blackstone has more than 665 million views on the social media app.

Blackstone customers are very loyal and outspoken about the brand. In addition to TikTok, it has 1.5 million griddle group members on Facebook, 100,000 subscribers to its YouTube channel and 140,000 followers on Instagram.

Investors have a chance to bite into Blackstone now as it heads into a formal public listing. The company is merging with blank-check company Ackrell SPAC Partners I Co. (Nasdaq: ACKIT, ACKIU, ACKIW), in deal that values the griddle maker at roughly $900 million. The deal is expected to close in the second quarter under the new ticker symbol “BLKS.”

Well-known grill makers Weber Inc. and Traeger Inc. went public through traditional initial public offerings last year, as did Solo Brands Inc., owner of the popular Solo Stove outdoor fire-pit brand. But griddling, in particular, is still in an early stage of adoption and growth has been accelerated by social media sharing.

Already, Blackstone’s griddles are easy to find online or in most towns with major retailers. The company has long-term relationships retailers including Walmart, Lowe’s and Amazon, plus direct-to-consumer sales.

Unlike many SPAC deals, Blackstone is already a real business with financials to prove it. The company expects over $600 million in revenue in 2022. Ebitda is expected to come in at $81 million.

Blackstone’s griddles can be used across breakfast, lunch and dinner and it currently has more than 70 individual models. Those include large-scale models fit with air fryers along with portable versions ideal for tailgates or trips to the beach.

The core griddle portfolio accounts for 75% of revenue, with the remainder coming from higher-margin branded accessories and consumables, such as spatulas and griddle spray. It also continues to innovate, with a long pipeline of new products and features. Higher margin products, such as pizza ovens are part of the company’s growth recipe.

The company has the right leadership in place to take Blackstone to the next level. It is led by Founder and CEO Roger Dahle, whose previous positions include CEO of Cache Sales, VP of Sales for Icon Health & Fitness (now iFIT) and National Sales Manager for Johnson & Johnson.

Blackstone’s supply chain issues are limited thanks to key relationships and any short-term impact appears baked into its financials. The company’s main manufacturer Xiamen Cowell, owned by a Taiwanese family, also owns a significant part of the company. This long-standing relationship with a key supplier has been crucial during a time when competitors have faltered. Online grilling retailer BBQGuys terminated its SPAC deal that would have valued it at about $960 million, citing supply-chain disruptions affecting the company’s business.

Interestingly, the Akrell SPAC also has a feature that could limit redemptions: Investors who redeem shares may forfeit warrants (which came attached to shares in the IPO and that give the holder the right to buy more shares at a specific price in the future). That stands to minimize “warrant clipping” that can cause headaches when investors redeem shares and keep the warrants they essentially received for free at the IPO.

The deal is priced right – and based on a real earnings multiple – at 11.1 times 2022 Ebitda. By contrast, Weber trades at 13.7 times this year’s consensus Ebitda, according to Sentieo, an AI-enabled research platform. Traeger, meanwhile, trades at 12.1 times.

With a $5.7 billion global TAM, expanding into markets across Europe, Asia, Latin America is already underway. The company plans to leverage the broad multi-cultural appeal of griddle cooking. It’s also made key hires in sales and marketing focused on international expansion and is in active discussions with key retailers in Canada, Mexico, Australia and Europe.

Bottom line: People love cooking all meals on Blackstone griddles, and the company’s growth has been dynamic despite still building overall awareness. Also, who doesn’t love a good cheeseburger video?

Contact:

Jarrett Banks, Editor-at-Large

jb@capmarketsmedia.com

Twitter: @IPOEdge

Instagram: @IPOEdge