- Footprint merging with Gores Holdings VIII Inc. (Nasdaq: GIIX), led by veteran investor Alec Gores

- Materials-science tech firm replaces single-use plastic with plant-based materials

- Increased government regulation, corporate sustainability boosting business

- Footprint provides water, oil insulation, similar to plastic solutions at similar price

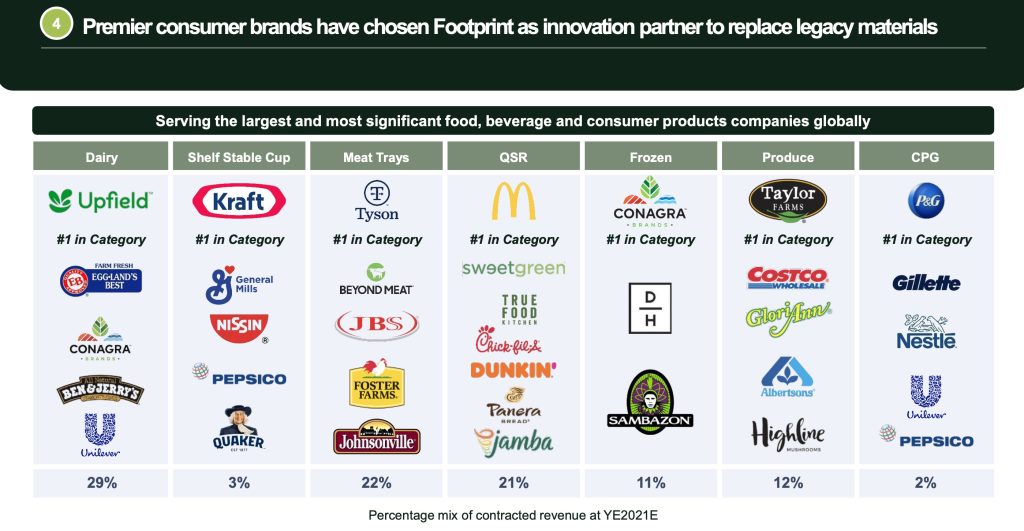

- Customers include Kraft Heinz Co., McDonald’s Corp. and Procter & Gamble Co.

- Investors include Sweetgreen Inc., Conagra Brands Inc., JBS

- Already sold out of capacity through 2023, on track to selling out through 2024

- Expects $500 million in 2023 sales vs. $135 million in 2022; more upside possible

- Footprint expects Ebitda positive in early 2023

- Priced at 3.2x 2023 revenue, below Plug Power, Inc., ChargePoint Holdings, Inc.

By John Jannarone and Jarrett Banks

From microwaveable noodle cups to meat trays, grocery stores are loaded with plastic that almost everyone with rather do without. Now, an Intel Corp.-trained engineer has served up a solution that’s selling as fast as his company can deliver it.

Meet Footprint, the leading manufacturer of plant-based packaging that competes both on performance and price with plastic alternatives throughout grocery aisles. Footprint is going public through a merger with Gores Holdings VIII Inc. (Nasdaq: GIIX), led by Wall Street veteran Alec Gores whose successful track record with SPACs goes back to Hostess Brands, Inc. which has thrived since its return to public markets in 2016.

The demand for Footprint’s packaging comes from every direction. Consumers now vastly prefer plant-based materials over plastic – both because they don’t want to put petroleum in their food (humans ingest a plastic credit card in weight per week) and are mindful of environmental damage. Big Footprint customers have serious goals to meet: McDonald’s Corp., for instance, plans to source 100% of packaging from renewable, recycled or certified sources by 2025.

And governments worldwide are taking strides to reduce carbon emissions and plastic waste that can linger for centuries. The EU banned certain single-use plastics effective last year and is committed to reduce single-use packaging by 2026. China mandated a 30% reduction in the consumption of single-use plastics in restaurants by 2025. In the U.S., cities and states are prohibiting Styrofoam and plastic containers in the food service sector.

To understand why Footprint’s solution is superior, it’s important to know its history. Founder Troy Swope, who sports a “Plastic Kills” t-shirt in the video above, oversaw R&D at Intel where he introduced new materials science technologies resulting in over $350 million in cost savings. Mr. Swope and Co-Founder Yoke Chung, another Intel alumnus, brought their tech savvy to Footprint when they started the business in 2013 and took a unique approach. Rather than choose a single input to create materials, he sought to create an entire ecosystem that took the best of all plant-based ingredients.

The result is a rigid material that’s cost competitive with plastic and also offers high performance – customized by specific need. For customers like ConAgra Brands, Inc., which has worked with Footprint since 2017, it’s important that packaging is oven and microwave safe (unlike plastic which bleeds into food) and has an 18-month shelf life.

Tyson and Walmart, meanwhile, had their own set of needs for meat trays. They requested trays that were stronger than plastic, non-stick, oil and water leak proof and snap proof. Footprint delivered.

The list of top-tier leaders goes on. In dairy, Footprint works with Upfield along with Ben & Jerry’s. In produce, it has deals with Albertson’s and Costco. In consumer packaged goods (CPG), the company’s customers includes Procter & Gamble and Unilever.

Important to note is that Footprint has focused on grocery stores. The company’s rigid materials with plastic-like performance have essentially no competition in the plant-based world. That head start should last for years to come as companies increasingly shift away from petroleum-based packaging.

Partners like Sweetgreen also provide a chance to build loyalty at the consumer level, with the “Footprint” brand visible on the restaurant chain’s trays. Similarly, the Arizona-based company has a deal with the Phoenix Suns to provide plastic-free products and to name the arena “Footprint Center.”

Another sign of strong demand: Long term contracts. As of the date of the company’s investor presentation, it had 54 customers with a weighted average duration of 6 years. Some customers like Conagra and Sweetgreen have also become investors in Footprint.

Where will Footprint deploy the fresh cash from the deal? Most important is a plan to expand manufacturing capacity through factories in places including Mexico, Poland and the Netherlands.

Investors should take comfort in the fact that much of the new capacity is essentially spoken for. Footprint’s $500 million in expected 2023 revenue is already more-than covered by firm contracts. And when the company reported first quarter results, it said that it’s on track to sell out all of its 2024 capacity – indicating the $997 million revenue forecast for that year is nearly locked in.

What’s more, Footprint could easily top its own forecasts. The expectation for $500 million in 2023 sales doesn’t account for a number of factors suggesting upside. Utilization ramp up is modeled at six months, representing the pandemic-era pace. That could be as fast as three months thanks to operational improvements Footprint has already implemented. Similarly, new systems were implemented at a pace of four to five per month during the pandemic but there’s room to increase that to a pace of seven to nine per month.

And revenue opportunities from the Phoenix Suns deal are significant. Customer demand for additional products includes catering trays, lids, bags, straws and utensils – all of which point to higher sales and even a profit.

Footprint’s profit profile should also attract investors who want to see earnings sooner rather than later. The company will swing to positive Ebitda early in 2023 and in the long term expects a margin of 30% or higher.

Very importantly, Footprint is priced conservatively at an enterprise value of 3.2 times 2023 forecast revenue. That’s well below comparable companies – even in the face of recent dramatic declines in their share price: Plug Power Inc. trades at 4.2 times, according to Sentieo, an AI-enabled research platform. ChargePoint Holdings, Inc. trades at 5.3 times.

Finally, investors should note Messrs. Swope and Chung aren’t the only stars on the Footprint team. Others include Don Thompson, Chairman of Footprint, who brings serious industry credentials. He was not only CEO of McDonald’s but has served on multiple boards including Beyond Meat that give him a window into what customers want. Brad Lukow, CFO, was previously Co-CEO and CFO of Sprouts Farmers Market, Inc. – another C-Suite executive with public company experience in the grocery industry.

In recent months, innovative technology companies have taken a thrashing on Wall Street. But it would be a mistake to deny the future of plant-based packaging. With top-notch leadership, proven tech, contracts to back its forecasts and a sensible valuation, Footprint is an opportunity that savvy investors shouldn’t pass up.

Contact:

www.IPO-Edge.com

Editor@IPO-Edge.com

Instagram: @ipoedge

Twitter: @ipoedge