- Digital learning pioneer Skillsoft going public via merger with Churchill Capital Corp II

- To be led by incoming CEO Jeff Tarr, a veteran C-suite executive from IHS, Hoover’s, DigitalGlobe

- Skillsoft is profitable with Ebitda expected to grow 12{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} annually from 2020-2022

- Valued at 7.6 times 2022 Ebitda, a fraction of comps Pluralsight, Learning Technologies

- Stock trading near cash in trust, limiting downside for investors before deal closes

- Expected leverage of just 0.6x Ebitda clears the way for accretive acquisitions

- Technology investment giant Prosus Group contributing $500 million to $530 million PIPE

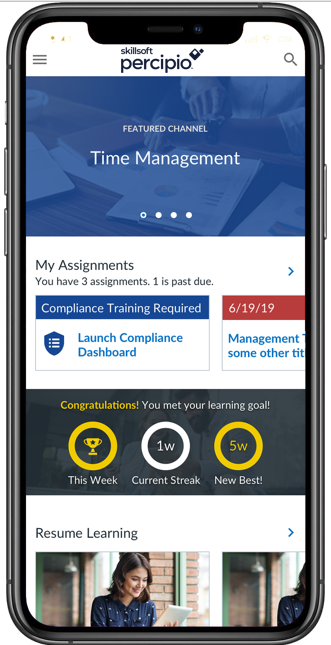

- Skillsoft is only player in industry offering wide breadth of courses; allows cross-selling

- Already has largest salesforce and adding 30 new “hunters” to boost customer acquistion

Investing in SPACs has proven a wild ride for those drawn to spacecraft, flying taxis, and other futuristic contraptions. But for those seeking an investment backed by profits, proven leadership, and a fair valuation, it should pay off to study digital learning pioneer Skillsoft.

Michael Klein’s Churchill Capital Corp II (ticker: CCX) is merging with both Skillsoft and Global Knowledge, a leader in IT and professional skills development, resulting in a single entity valued at $1.5 billion. Investors who buy shares of CCX now will see them automatically convert to shares of the newly-formed company after the deal closes in the second quarter.

Investors should think fast while the current opportunity lasts. While not as flashy as some of the moonshot SPAC deals currently in the market, Skillsoft has an immediate opportunity to profit from surging demand for digital learning. The COVID pandemic has accelerated adoption of Skillsoft’s platform and – as is the case with other recent behavioral shifts – corporations are unlikely to return to in-person classes that aren’t necessary.

There are several other structural tailwinds in Skillsoft’s favor. There’s a growing skills gap putting companies under pressure to improve the knowledge of their workforces; companies have been shifting to outsourced education instead of in-house; and classroom education has been scaled back even at giant corporations.

How much potential is there to grow? There is a $300 billion total addressable market for executive learning, but less than 10{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} of that is digital. That creates a big runway for a company like Skillsoft – which also stands to take more share from competitors as the largest player with $500 million in sales.

Across categories, Skillsoft already has a very strong position that can improve further. It’s number one in leadership and business skills while commanding a second-place position in both compliance and technology and development.

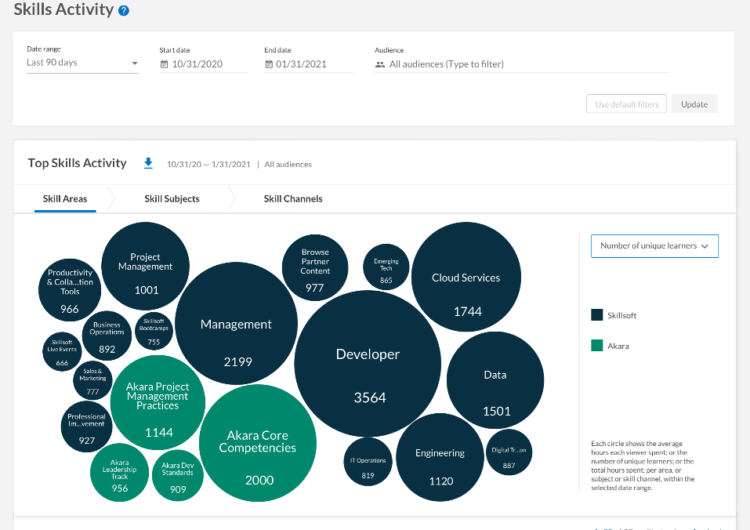

Central to Skillsoft’s strategy is to offer a broader range of content than rivals – who tend to focus on one segment. The approach has proven to work: When customers purchase across all three major categories, their business is much stickier, with a 22{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} higher dollar retention rate than for single-category clients.

Skillsoft has already demonstrated successful cross-selling between categories. The percentage of recurring revenue from single-platform customers has declined while the percentage from those on two or three platforms edged higher in the last few quarters.

Important to note is that Skillsoft offers its various learning services across a single platform called Percipio. The platform is AI-based, helping match students with the best courses to develop their skills and allowing easier cross selling because of the common user interface.

Skillsoft also knows that content is king. The company boasts a sprawling library of over 180,000 courses – many of which it owns outright having spent $100 million on them in the last few years. And customers tend to prefer Skillsoft’s proprietary content, which accounts for 90{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} of consumption.

Even with plenty of room for growth, Skillsoft has already achieved scale. As the industry’s largest player, Skillsoft has a sprawling presence across 160 countries where it teaches over 45 million learners. It counts dozens of the world’s largest companies as clients including 70{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} of the Fortune 1000.

For investors new to the sector, it’s critical to note that professional learning is very different from the for-profit university business, which targets students directly and has a checkered history of aggressive tactics. Skillsoft, on the other had, focuses purely on enterprise clients which have clear budgets in place and seeks recurring contracts that account for 2/3 of revenue.

Skillsoft already boasts the largest salesforce in the industry – but it’s only going to grow. The company is hiring 30 more “hunters” dedicated to securing lucrative enterprise clients relationships.

All this adds up to an impressive growth trajectory and profit profile. The company expected Ebitda to grow at an annualized 12{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} between 2020 and 2022, based purely on organic growth assumptions.

But there could easily be plenty of highly-accretive M&A in the next couple of years to boost profits further still. Assuming no redemptions, Skillsoft will have net leverage of just 0.6x Ebitda, leaving plenty of room for cash deals. Stock could also be used as a currency once the SPAC merger is complete.

Skillsoft will also have a veteran at the helm with incoming CEO Jeff Tarr, who brings a wealth of education-industry experience. He is the former CEO of both DigitalGlobe and Hoover’s and was also president of IHS. He’s also dedicated to education on a personal level as a graduate of Princeton University and Stanford University (and serves as the Chairman of the Management Board at the latter’s Graduate School of Business).

Mr. Tarr is also an experienced dealmaker, having executed about 40 M&A transactions prior to taking his current post. Skillsoft estimates there are over 1,000 possible tuck-in acquisitions with revenue under $100 million along with a few over $100 million.

Importantly, Skillsoft has secured a $500 million PIPE investment from Prosus Group (ticker: PRX in Amsterdam), a renowned technology investor that made early, smart bets on companies including Tencent and Delivery Hero. Prosus offers much more than a big check: the company, which will continue to play an advisory role with directors on the Skillsoft board, brings experience as an investor in several “EdTech” companies such as Brainly, Eruditus, and Codecademy.

For now, with the stock trading at $10, there is virtually no downside for Skillsoft shareholders because the shares can be redeemed for that much before the deal closes. But the upside is significant.

Indeed, Skillsoft trades at 7.6 times 2022 Ebitda. By comparison, Cornerstone OnDemand, Inc. trades at 13.3 times 2022 Ebitda, according to Sentieo, an AI-backed research platform. Learning Technologies Group PLC trades at 17.6 times and Pluralsight, Inc. at over 200 times.

Recently, anther Churchill SPAC – Churchill Capital Corp IV – has taken the spotlight in the leadup to its merger with electric vehicle maker Lucid Motors, which should have a dazzling future in coming years. But for investors seeking a company that’s already profitable and set to create tangible shareholder value imminently, Skillsoft is a wise bet.