- Plus Therapeutics, Inc. (Nasdaq: PSTV) specializes in targeted radiation treatments

- Rather than traditional radiation beams, Plus uses needle-sized applicators into brain fluid

- Focused on brain cancer which is difficult to reach through blood-brain barrier

- Targets 2 rare cancers: recurrent glioblastoma (GBM), leptomeningeal metastases (LM)

- Those 2 cancers combined have combined estimated TAM of $10.5 billion in treatment

- Secured Food & Drug Administration (FDA) Fast Track designation to treat both LM, GBM

- Awarded $17.6 million grant by CPRIT and $3 million grant from NIH

- Latest trials show safety, tight correlation between survival and absorbed doses

- Sufficient grants and cash for operations and trials through 2025

- Plus Therapeutics trades at a deep discount to fair valuation estimates

Certain types of brain cancer continue to cause death just weeks after diagnosis, often because they lurk in hard-to-reach places. Now, there’s a promising treatment that targets such tumors with more precision than ever – and investors have an unusual opportunity to bet on its success.

Meet Plus Therapeutics, Inc. (Nasdaq: PSTV), a cancer-focused biotech company that employs a highly-targeted radiation treatment. The two most advanced indications for the drug are highly aggressive brain cancers that cause tens of thousands of deaths per year, indicating a potential for billions of dollars in demand.

Such cancers have sadly been very difficult to treat despite advances in modern medicine. According to the National Brain Tumor Society, survival rates and mortality statistics have been virtually unchanged for decades and only a small number of drugs have been approved to treat them.

One issue is that the blood-brain barrier, a protective network of vessels, stops certain substances such as chemotherapy drugs from reaching brain tumors in large enough amounts to destroy them.

The other common alternative, traditional radiation therapy, is also problematic. Such radiation is directed at tumor cells with a beam that tends to reach healthy parts of the brain adjacent to tumor cells and cause serious damage.

Plus Therapeutics has found an encouraging solution by submitting radiation treatment with tiny tubes, or catheters, directly into the brain. The result is as much as 20 times the amount of radiation being absorbed by tumor cells without doing significant damage to surrounding brain tissue – meaning a patient’s lifespan can increase dramatically from weeks to months or even years.

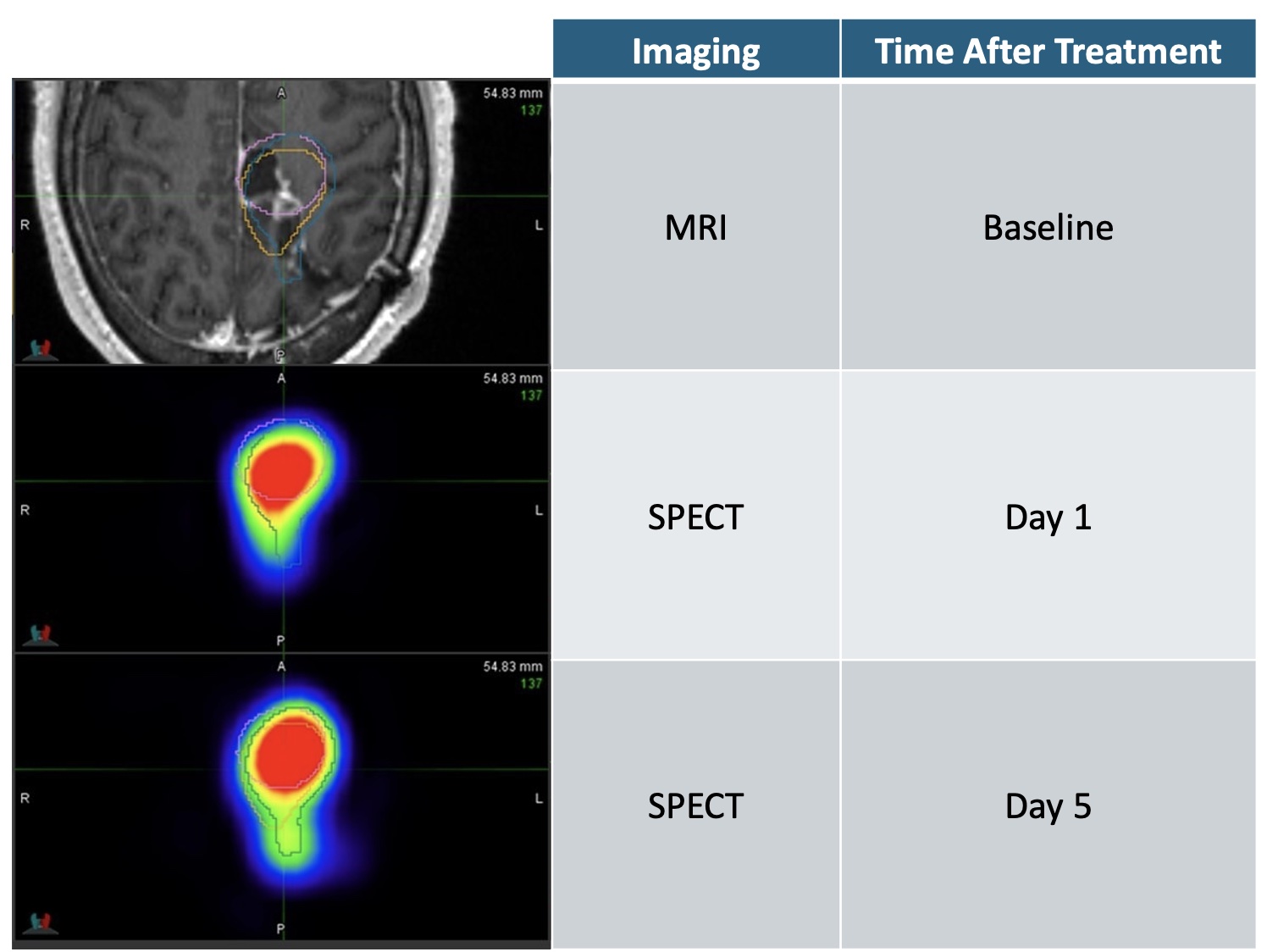

Axial view of patient’s brain & recurrent glioblastoma tumor, locally treated with high dose radiation that precisely covers and destroys the tumor for at least 5 days.

There are several indications that Plus Therapeutics is on the way to commercial success. On the regulatory side, the company has secured Fast Track designation from the U.S. Food and Drug Administration (FDA) for its two most important treatments: recurrent glioblastoma (GBM) and leptomeningeal metastases (LM). GBM is the deadliest and most common brain cancer in adults with a total addressable market (TAM) of about $2.1 billion. LM is a late-stage complication with a TAM of $8.4 billion that leads to death extremely quickly without treatment – just several weeks on average.

The FDA’s Fast Track designation can accelerate a treatment’s path to market in a big way. It allows more frequent meetings and written communication with the FDA to discuss development and trials and gives eligibility for Accelerated Approval, Priority Review and Rolling Review (meaning it can submit New Drug Application (NDA) materials for review piecemeal rather than waiting until every section is complete).

The FDA has also granted Plus Therapeutics a so-called orphan drug designation for treatment of patients with GBM. An Orphan drug designation entitles the manufacturer to financial incentives such as grant funding and fee waivers. It also means that if a product receives the first FDA approval for the orphan indication, the product is entitled to seven years of market exclusivity.

Looking ahead, Plus Therapeutics may secure the FDA’s Breakthrough Therapy designation in the no-too-distant future. Breakthrough Therapy designations provide all the benefits of Fast Track but also intensive guidance on an efficient drug development program and organizational commitment involving senior managers. The odds of winning Breakthrough Therapy designation look especially good for GBM treatment, which already has a strong and extended clinical trial record.

Indeed, Plus Therapeutics in November gave a key update on trials for both GBM and LM treatments. The GBM trial, which includes 24 patients so far, showed statistically significant improvement in overall survival correlated with both the average absorbed dose of radiation to the tumor and the percent volume of tumor treated, the company explained in a detailed presentation available here.

Importantly, several patients in the GBM trial have been alive for years since the study began in 2015 – compelling evidence supporting the case for commercialization. Plus Therapeutics is now enrolling patients in Phase 2 (more details are available on the trial website found here).

The LM trial, though it only began recently, also has shown signs of success in Phase 1 and could arguably proceed to commercialization as fast as GBM. The main reason is that LM has roughly 10 times as many patients as GBM, making it a serious priority in the medical community.

Cross-section of a patient’s brain and spine illustrating when locally treated with the Company’s lead investigational targeted radiotherapeutic, rhenium (186Re) obisbemeda, the radiation circulates rapidly in the cerebrospinal fluid and migrates to the leptomeninges within 24 hours to precisely destroy cancer cells.

How soon could commercialization be within reach? Realistically, both GBM and LM could complete Phase 2 within a couple of years. They could both continue into Phase 3 or even be approved for sale on the market faster if the FDA decided they were ready. Justin Walsh, PhD of JonesResearch, estimates the LM treatment will be approved in 2026 and GM in 2029.

In the meantime, the good news is that current trial costs thorugh Phase 2 are largely covered by grants from the most highly-regarded institutions in the country. Those include a $17.6 million grant by the Cancer Prevention & Research Institute of Texas (CPRIT) and a $3 million grant from National Institutes of Health (NIH). Both are also strong signs of validation of the drug’s prospects.

The company also had a healthy stockpile of $20.3 million in cash as of the end of the third quarter. Plus Therapeutics has said the combination of cash, grant funding and existing discretionary capital sources provide sufficient sources to fund operations through 2025. By that time, Plus Therapeutics could likely issue new equity or debt – particularly if trials continue to succeed.

What’s more, Plus Therapeutics is in a specialized field that’s drawn the attention of biotech giants and seen significant M&A activity. In 2018, for instance, Novartis AG paid $2.1 bilion to buy Endocyte, a US-based biopharmaceutical company focused on developing targeted therapeutics for cancer treatment for $2.1 billion. Last year, Lantheus Holdings Inc. agreed to license certain rights from POINT Biopharma Global Inc., another radiopharmaceutical company, for $260 million upfront plus hundreds of millions more if certain milestones and regulatory hurdles are met.

Turning to valuation, the company has a market capitalization of just $11 million. While difficult to judge the precise odds of success, even a small share of the multibillion-dollar LM and or GBM markets would be worth many multiples of that amount.

Dr. Walsh’s recent initiation report on Plus Therapeutics assigned a target price of $5 a share. That analysis is based on a detailed cash flow model assigning steep discounts to adjust for probabilities of success and commercialization around the world. Even a target of half that, say $2.50 a share, would indicate upside of about 7.5x from current share-price levels.

Of course, investing in biotech carries risks, particularly when drugs have yet to hit the market. But Plus Therapeutics has already shown it can deliver a promising drug to elusive cancers in one of the trickiest parts of the body to treat. With sterling institutions backing the company thorough grants and strong momentum in key trials, Plus Therapeutics has all the right ingredients to be a survivor.

Contact:

IPO Edge

Twitter: @ipoedge

Instagram: @ipoedge