- Stable Road is still 6{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} short of the 65{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} needed to approve an extension amendment

- Extension amendment must be approved by May 13 to prevent SPAC from being dissolved

- Investors show very strong support for deal with stock trading at $11 vs. $10.03 cash in trust

- If SPAC is dissolved shareholders will receive $10.03 in cash through forced redemption

- Institutions have already voted so remaining votes must come from individual retail investors

- IPO Edge and Palm Beach Hedge Fund Association hosted fireside with Stable Road, Momentus

- Fireside video recording (roughly one hour) and slide deck are available HERE

- Most U.S. shareholders can easily vote via brokers on their websites

- Shareholders can also ask for assistance from Morrow Sodali LLC at 877-787-9239

- Shareholders can also email SRAC.info@investor.morrowsodali.com

Stable Road Acquisition Corp. has secured votes representing 59{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} of outstanding shares in support of a key vote but remains 6{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} short of the total amount needed to prevent the special purpose acquisition company, or SPAC, from being dissolved and cash in trust returned to shareholders.

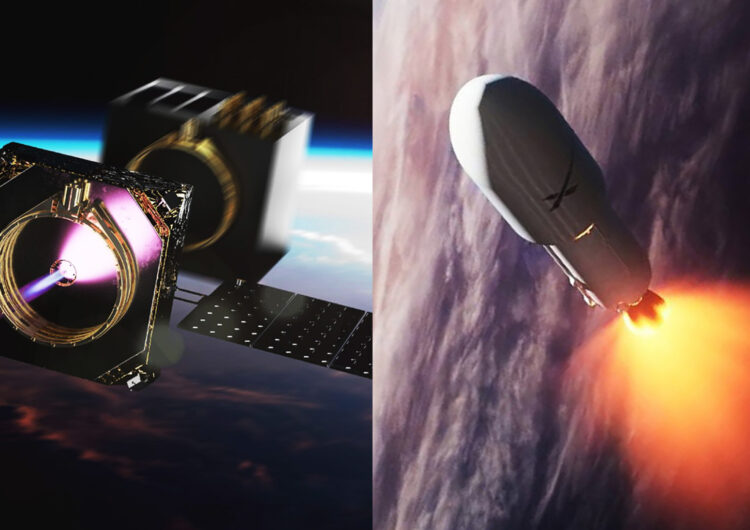

Stable Road has agreed to merge with Momentus, a company that provides last-mile services such as moving satellites and other equipment once it is in outer space. The SPAC needs more time to secure routine regulatory approval, which is why the extension was requested.

The deal is very well supported by investors, with the stock trading around $11, a full 10{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} above the value of the SPAC’s cash held in trust. That indicates that shareholders overwhelmingly support the deal but many of them have simply not voted their shares.

Another strong sign of support comes from PIPE investors, who have committed to investing $175 million. Those investors include private equity funds, family offices and top tier public institutional investors. Leading independent voting advisory firm Institutional Shareholder Services has recommended stockholders vote for the extension.

The business also looks very promising, with a growing pipeline of $2 billion in deals currently under negotiation. The company has partnered with key players in the space industry, including Elon Musk’s SpaceX and Made in Space – though it intends to be compatible with any spacecraft.

The peculiar situation has come about largely because the company has a very large number of individual retail investors on its shareholder roster. Institutions have people who manage shareholder votes but many smaller investors simply haven’t spent the time to vote – putting the deal at risk. Any shareholder – large or small – who owned SRAC shares on March 22 can vote.

IPO Edge and The Palm Beach Hedge Fund Association hosted an hour-long fireside chat this week with Momentus CEO Dawn Harms, Momentus CTO Rob Schwarz, and Stable Road Acquisition Corp. Chairman and CEO Brian Kabot to discuss the transaction and offer tips on how to vote. The entire video and the associated slide deck are available here on IPO Edge.

If the necessary 65{efe5d79870c08482e17ab0c97855f89429dac5f22c46026d3ca83573faec2208} of shares are not voted by May 13, the SPAC must dissolve. That would prompt the company to return $10.03 per share to all shareholders through a forced redemption.

In most cases, investors can simply log onto their brokerage platform such as Charles Schwab or Fidelity and cast votes. The company has also told shareholders to contact Morrow Sodali LLC at 877-787-9239 or SRAC.info@investor.morrowsodali.com for assistance.

Contact IPO Edge:

John Jannarone, Editor-in-Chief

Twitter: @ipoedge