- Athena Technology Acquisition Corp. (NYSE: ATHN) to merge with Heliogen, Inc. in SPAC deal

- Heliogen provides AI-enabled concentrated solar power

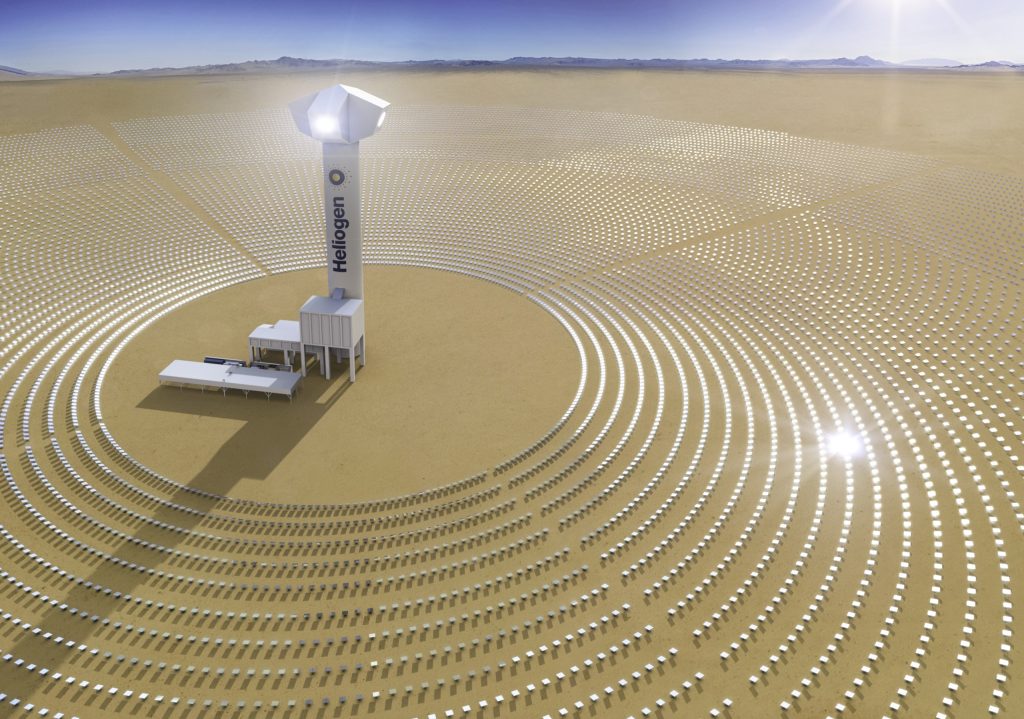

- Heliogen’s proven technology uses mirrors to reflect sunlight at a small receiver, generating intense heat

- Heliogen CEO is entrepreneur Bill Gross, who has seven startups backed by his Idealab incubator

- SPAC Athena led by CEO Phyllis Newhouse, Xtreme Solutions founder, 22-year Army veteran

- PIPE investors include ArcelorMittal and Morgan Stanley’s Counterpoint Global

- Backed by billionaire investors including Bill Gates, Patrick Soon-Shiong

- Customers include U.S. Department of Energy, ArcelorMittal, Rio Tinto, Bloom Energy

By Jarrett Banks and John Jannarone

Energy is the biggest industry on earth and the single biggest cost. With a TAM of $7 trillion a year and major countries decarbonizing, the switch to renewable energy to fight climate change has become big business. How should investors bet on a green future?

Get plugged into Heliogen Inc., which provides AI-enabled concentrated solar power and was founded in 2013 through Idealab, a Pasadena-based startup accelerator run by serial entrepreneur Bill Gross. It’s merging with Athena Technology Acquisition Corp. (NYSE: ATHN) in SPAC deal with a valuation of $2 billion.

Athena Technology is run by all women, including the CEO Phyllis Newhouse, a cybersecurity executive and former U.S. Army officer, as well as Board Chair Isabelle Freidheim, a venture capitalist. Former Georgia Democratic gubernatorial candidate Stacey Abrams is one of its advisers.

Heliogen’s refineries use artificial intelligence to position mirrors to reflect sunlight at a receiver, generating heat above 1,000 degrees Celsius. The heat is stored in rocks out of a quarry, providing around-the-clock renewable energy. This means the company doesn’t need batteries, greatly simplifying the model.

The company’s modular system, which is easy to scale, delivers low-cost renewable energy in the form of heat, power or hydrogen fuel. The goal is to replace fossil fuels in industrial processes including the production of cement, steel and petrochemicals. About 100 megawatts of electrical energy can be produced with around 20 modules.

Hydrogen is a $100 billion a year market today. Assuming the shift away from fossil fuels continues, it could soon reach $1 trillion a year. (The sole waste product from hydrogen is water – about as clean as it gets).

Demand is already off the charts. Customers include steelmaker ArcelorMittal SA, mining giant Rio Tinto PLC, Bloom Energy along with a yet to be announced Australian oil and gas company. With Heliogen, they are locking in energy prices for decades.

Indeed, the equipment is built to last. Even in harsh climates such as deserts, Heliogen’s structures are tested to survive sandstorms and operate for decades.

Heliogen’s 24/7 power delivery gives it a critical advantage over other green energy sources such as windmills. ArcelorMittal is evaluating uses of the company’s technology at its plants, while Rio Tinto is a looking at working with Heliogen at a mine in California.

Heliogen and Bloom Energy plan to produce green hydrogen using only concentrated solar power and water. The duo plans to leverage Heliogen’s Sunlight Refinery solar power generation system and Bloom Energy’s solid oxide electrolyzer, with the first integrated solution expected to be deployed by the end of 2021. Heliogen was also awarded $39 million by the U.S. Energy Department late last year to advance its technology.

Importantly, Heliogen’s customers have so far paid all cash upfront for its services. Such large players have the financial muscle to make such payments and should continue to do so going forward.

Heliogen has strong financial backing – both from customers who are also investors along with institutional money. PIPE investors include ArcelorMittal and Morgan Stanley’s Counterpoint Global. Early investors include Bill Gates and billionaire biotech investor Patrick Soon-Shiong.

The Microsoft founder, who is surely difficult to impress, is very enthusiastic about the business. In an interview with IPO Edge, Mr. Gross said, “When I told Bill Gates about building a software-enabled power company, he was very excited.”

At its core, Heliogen is a software company with potential for very high profit margins. Powerful analysis allows it to improve performance at its power plants constantly, making them ever more efficient. Such a business model could eventually put the company in an elite class of companies such as Tesla.

Heliogen’s technology is also well protected from copycats. The company has a strong portfolio of six granted and 13 pending patents. And its forecasts don’t even include potential government subsidies or mandates, carbon taxes or credits, or future software licensing revenues, which could represent a huge upside.

Mr. Gross will continue in his position as CEO at the combined company, and its current executive team will remain intact. Athena’s CEO, Ms. Newhouse, will also join the combined company’s board.

Athena, trading just below $10, is priced with room to rise. With an enterprise value of $2 billion, it has a multiple of 3.5 times sales. SunEdge Technologies, Inc., meanwhile, trades at 3.9 times while Sunrun Inc. trades at 7.7 times, according to Sentieo, an AI-enabled research platform.

It’s important to remember that a mission-driven company like Heliogen is able to attract engineering talent, giving it an advantage similar to Tesla. The company is also likely to get noticed by more smart investors.

Contact:

Jarrett Banks, Editor-at-Large

Twitter: @IPOEdge

Instagram: @IPOEdge